It’s now mandatory to link your PAN card to your Aadhaar for various services, including filing income tax returns. The deadline for this is March 31, 2023, as per a recent government notification (extended from the earlier cutoff of March 31, 2022). After March 31, 2022, late linking will result in penalties – Rs 500 if linked between April 1, 2022, and June 30, 2022, and Rs 1,000 if linked between July 1, 2022, and March 31, 2023. To check your Pan Aadhaar Link Status, you can do so both online and offline, provided your PAN and Aadhaar are already linked. Learn how to check the status through the Portal or SMS, understand the importance of linking PAN and Aadhaar, and more by reading below.

Everything You Need to Know About Pan Aadhaar Link Status: Deadline, Penalties, Check Status, and Importance

Connecting your PAN card with your Aadhaar has become mandatory for various services, including filing income tax returns. The government recently extended the deadline for this to March 31, 2023, from the earlier cutoff of March 31, 2022. After March 31, 2022, delayed linking may result in penalties, with Rs 500 for links made between April 1, 2022, and June 30, 2022, and Rs 1,000 for links made between July 1, 2022, and March 31, 2023. You can check your Pan Aadhaar Link Status online or offline if your PAN and Aadhaar are already linked. Discover how to verify the status through the Portal or SMS, learn about the significance of linking PAN and Aadhaar, and more by reading below.

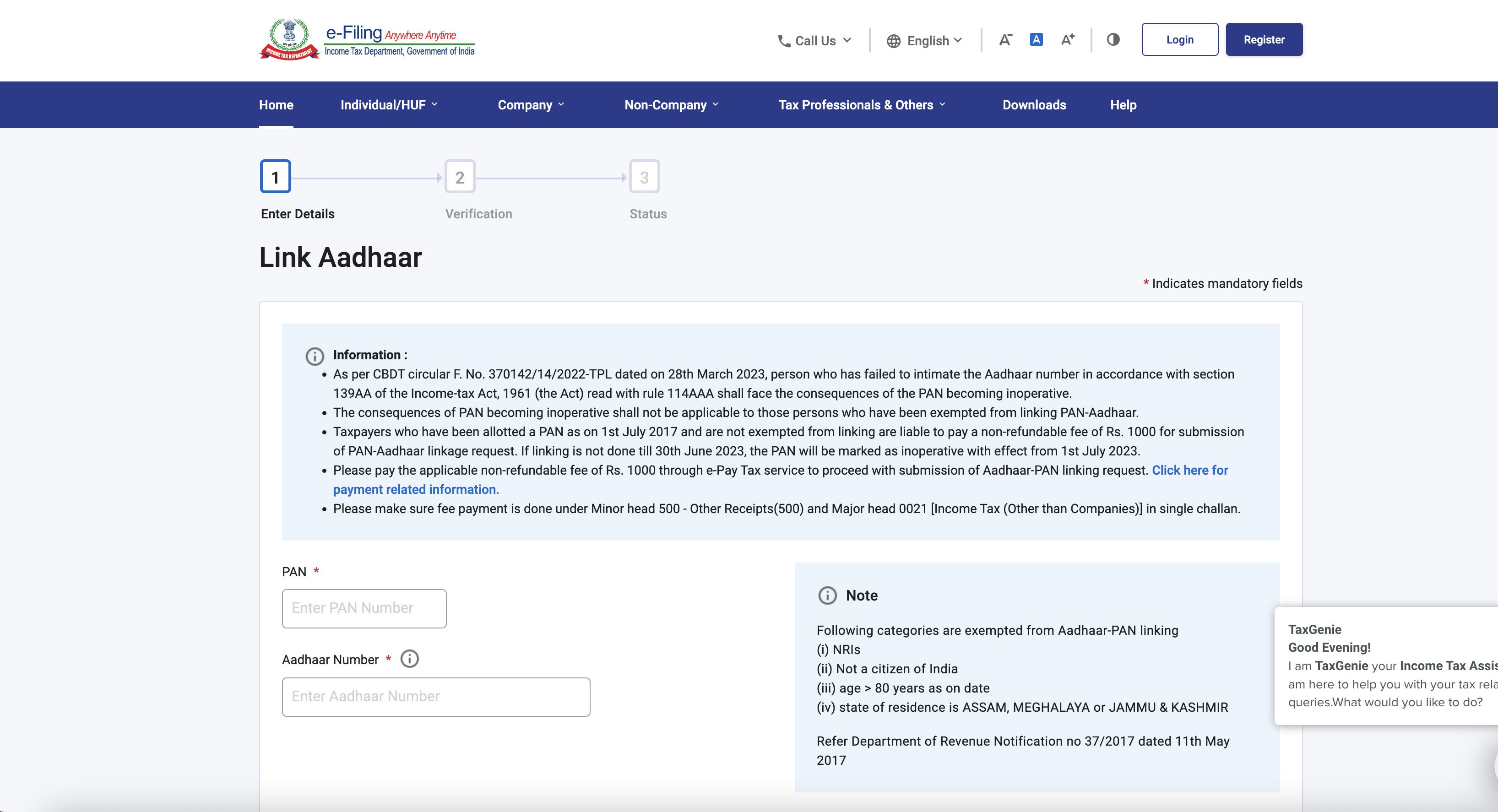

- Through the Income Tax e-filing Portal

- By sending an SMS to 567678 or 56161

Highlights of Aadhaar Card and PAN Card Link Status Details :

| Name | Pan Aadhaar Link Status Check |

| Objective | To check the status of the Pan Aadhaar Link |

| Deadline for Pan Aadhaar Link | 30 June, 2023 |

| Fee | 1000 /- Rs |

| Official Website | https://www.incometax.gov.in/iec/foportal/ |

Online Procedure to Check PAN Card Aadhaar Card Link Status:

Step-by-Step Guide to Check PAN Aadhaar Link Status through Portal:

- Visit the official income tax e-filing website

- On the homepage, locate and click on the ‘Link Aadhaar Status’ tab

- You’ll be redirected to a new page

- Enter your PAN and Aadhaar numbers

- Click on the ‘View Link Aadhaar Status’ button

- The status will be displayed on the screen

How Can We Verify PAN Aadhaar Link Status via SMS:

Steps to Check PAN Aadhaar Link Status through SMS:

- End an SMS to 567678 or 56161

- The SMS should have the following format: 12-digit Aadhaar number>10-digit Permanent Account Number>UIDPAN

- After sending the SMS, you’ll receive a message on the screen

- If the Aadhaar and PAN are linked, the message will read: “Aadhaar…is already associated with PAN (number) in ITD database”. Thank you for using our services.

- If the Aadhaar and PAN are not linked, the message will state: “Aadhaar…is not associated with any PAN in the ITD database

Significance of Linking PAN and Aadhaar :

Importance of Linking PAN and Aadhaar:

PAN is a vital document for all tax-paying residents. Here are some of the reasons why you need to link your PAN and Aadhaar

- To pay direct taxes and file tax returns

- To avoid excessive taxation

- For specific transactions, such as the sale or purchase of immovable property worth over Rs. 5 lakhs, buying or selling a vehicle, payment for international travel, or making one-time payments over Rs. 25,000 to hotels/restaurants

- To purchase bonds, debentures, or mutual funds, buy shares from a corporation, or acquire bullion and jewelry worth over Rs. 5 lakhs

- To deposit over Rs. 50,000 in a bank within 24 hours

What Happens If You Do Not Link PAN and Aadhar

Failing to link your PAN with Aadhaar by June 30, 2023, will render your PAN inoperative, preventing you from using it for filing, intimating, or quoting. This non-compliance triggers consequences under the Income-tax Act. Taxpayers must ensure the mandatory linking of their Permanent Account Number (PAN) with Aadhaar before the June 30, 2023 deadline, as failure to do so results in PAN inoperability starting July 1, 2023.The deadline for Aadhaar intimation to the prescribed authority for PAN and Aadhaar linkage is now extended to June 30, 2023.From July 1, 2023, if taxpayers fail to link Aadhaar as required, their PANs will become inoperative, leading to the following consequences:

- No refunds against inoperative PANs.

- No interest payable on inoperative PAN refunds.

- Higher TDS and TCS deduction/collected rates, as specified in the Act

To reactivate an inoperative PAN, taxpayers must intimate their Aadhaar to the prescribed authority within 30 days, accompanied by a fee of Rs. 1,000

What Is PanCard And Used For

A PAN Card, short for Permanent Account Number Card, serves as a distinctive identification card issued by the Income Tax Department of India. This 10-character alphanumeric identifier is crucial for establishing identity for both individuals and entities in India, particularly for financial and taxation purposes.

Key Points about PAN Cards:

- Unique Identifier: Each PAN Card possesses a distinct combination of letters and numbers, aiding the government in tracking financial transactions and preventing tax evasion.

- Mandatory for Financial Transactions: PAN Cards play a vital role in various financial dealings such as opening bank accounts, receiving salary, purchasing or selling assets like property or vehicles, and investing in securities.

- Taxation: Filing income tax returns in India mandates the use of PAN, linking an individual’s or entity’s financial transactions with their tax liabilities.

- Identity Proof: Widely accepted as a proof of identity, PAN is a requisite document for many government and non-government agencies. International Use: PAN Cards extend beyond Indian borders and can serve as proof of identity for international financial transactions and investments

For comprehensive financial and tax compliance, having a PAN Card is not only essential within India but also holds significance for international dealings.

What Is AadharCard And Used For

The Aadhaar card, a biometric document, holds significant importance as proof of identity and address in India. Featuring a unique 12-digit universal identification number, it securely stores individuals’ personal details in a government database. This essential document is increasingly becoming a necessity for every individual, playing a pivotal role in public welfare schemes and citizen services

Benefits of Aadhaar Card:

- Universal Authentication: Aadhaar offers a flexible method of authentication, allowing individuals to verify their identity through electronic and offline means.

- Document Consolidation: With Aadhaar, individuals no longer need to carry multiple documents, as it serves as a universal proof of identity and address.

- Opening Bank Accounts: Aadhaar is essential for initiating the process of opening bank accounts, streamlining the verification process

- Filing Income Tax Returns: Aadhaar is a mandatory requirement for filing income tax returns, linking individuals’ financial transactions with their tax liabilities.

- Applying for a Passport: The Aadhaar card is a crucial document when applying for a passport, facilitating the identification and verification process.

- Using DigiLocker: Aadhaar is integrated with DigiLocker, providing individuals with a secure and paperless platform for storing and accessing essential documents.

- Digital Life Certificate: Aadhaar plays a vital role in obtaining a digital life certificate, ensuring a streamlined and efficient process for pensioners

In summary, the Aadhaar card is not only a proof of identity but also a key facilitator for various services, simplifying processes and enhancing efficiency in areas such as banking, taxation, travel, and digital document storage. Explore the manifold uses and advantages of the Aadhaar card for a seamless and integrated approach to identity verification and documentation